How to make a change and invest in a peaceful future

"[We are facing] a time of nuclear danger not seen since the height of the Cold War."- UN Secretary-General António Guterres

The largest U.S. mutual fund managers, responsible for funds found across thousands of corporate 401(k) plans, have significant investments in nuclear and other controversial weapons like cluster bombs and white phosphorus. While nations have the right to the legitimate use of weapons for self-defense and national security, having investor-owned arms manufacturers in retirement plans puts people in the position of profiting from this bloodshed.

Given a choice, many would not want to profit from companies that manufacture weapons of mass destruction.

Concerns about social impact, human rights, reputation risk, and regulatory risks are just a few of the reasons weapon-free investing has been a common component of sustainable investing for decades. These risks are amplified when companies are involved with nuclear weapons and controversial weapons like cluster munitions, anti-personnel landmines, incendiary weapons, and depleted uranium.

We can help build a more peaceful world by shifting our investments away from war and violence.

Find your funds

Before finding out what weapons companies might be hidden in your investments, first login to your investment account, and write down the list of funds you are currently invested in. You will use this list in the next step.

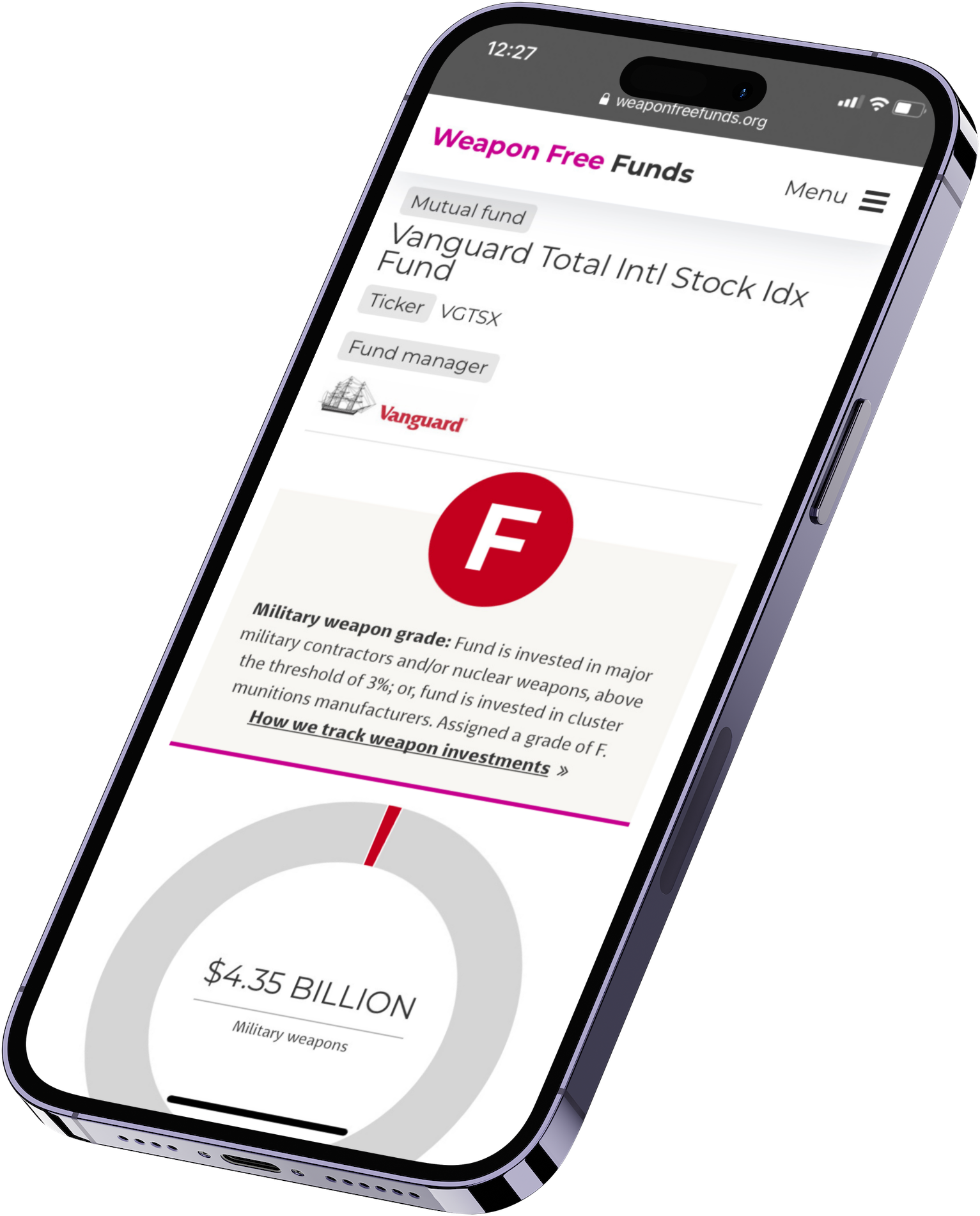

Know what you own

Check to see if your investments are weapon free. Use your investment list from step 1 to find your fund grades. You can search for mutual funds and exchange-traded funds (ETFs) by name, ticker, or asset manager. Our database covers 3,000 stock funds available in the U.S.

Take action

If your investments are exposed to weapons companies, now is the time to sort and compare weapon free alternatives. You can sort by performance and see how funds score on other issues, like climate change. Once you have a found funds that meet your investing circumstances, you can talk to your financial advisor or retirement plan administrator to invest weapon free.

Disclaimer: As You Sow is not an investment adviser

See our full disclaimer